Financial management software provider Intacct recently

Financial management software provider Intacct recently  Financial management software provider Intacct recently held its fourth annual user conference. In addition to a long list of enhancements in current and upcoming product releases, the company used the occasion to announce Intacct Collaborate, a capability built into its software that enables finance and accounting organizations to work together to answer questions or resolve issues while performing a process. Our benchmark research shows that collaboration ranks second in importance behind analytics as a technology innovation priority. Collaborative capabilities in software will multiply over the next several years as software transitions from the rigid constructs established in the client/server days, which force users to adapt to the limitations of the software, to fluid and dynamic designs that mold themselves around the needs of the user. A while back, I noted that finance and accounting organizations need collaborative capabilities although they might not realize it. At the same time, finance departments have their own requirements for these systems that reflect the character and constraints of the work they do. This means narrowcast, not broadcast, feeds (Finance doesn’t want a Facebook or Twitter experience because it considers much of what it does to be confidential) and in-context collaborative capabilities to simplify the working environment.

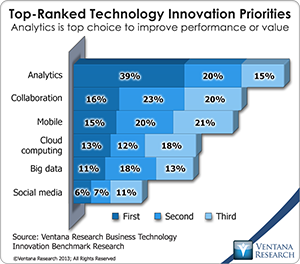

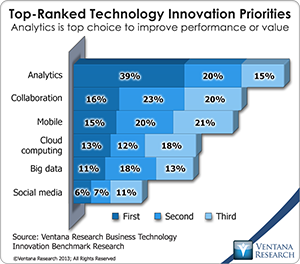

Financial management software provider Intacct recently held its fourth annual user conference. In addition to a long list of enhancements in current and upcoming product releases, the company used the occasion to announce Intacct Collaborate, a capability built into its software that enables finance and accounting organizations to work together to answer questions or resolve issues while performing a process. Our benchmark research shows that collaboration ranks second in importance behind analytics as a technology innovation priority. Collaborative capabilities in software will multiply over the next several years as software transitions from the rigid constructs established in the client/server days, which force users to adapt to the limitations of the software, to fluid and dynamic designs that mold themselves around the needs of the user. A while back, I noted that finance and accounting organizations need collaborative capabilities although they might not realize it. At the same time, finance departments have their own requirements for these systems that reflect the character and constraints of the work they do. This means narrowcast, not broadcast, feeds (Finance doesn’t want a Facebook or Twitter experience because it considers much of what it does to be confidential) and in-context collaborative capabilities to simplify the working environment.

Intacct Collaborate can address these needs. Built on Salesforce Chatter, it enables a company to connect finance, accounting, sales, customer support and other functions across all financial processes on a variety of devices, including mobile ones, allowing anywhere, anytime conversations to speed approvals. Collaborate eliminates the need to leave the Intacct environment to send email or instant messages. Instead, the discussion takes place in context, for example, while resolving a customer billing or credit issue, a project time card or a purchase order, or in handling a journal entry. These discussions remain part of the invoice, purchase order, journal entry and can be referenced at any later date if questions arise or to inform internal or external auditors about the context of some action. The addition of collaborative capabilities is an important step for Intacct. Having collaborative capabilities in a financial application is rapidly evolving from “Why do I need this?” to a must-have capability because of its impact on productivity, organizational effectiveness and financial and operational controls. Companies that already license Chatter will be able to use it as their work environment, meaning that, for example, sales and customer service representatives who are working in Salesforce do not have to move to Intacct to facilitate the resolution of an invoice issue. The user company is not charging an additional fee for Collaborate: It’s part of the service. However, individual employees who do not already have a Chatter license must acquire a nominal Intacct license to be able to work with other Intacct users.

Intacct also announced that it is partnering with American Express Global Corporate Payments to offer an automated check payment service. After establishing the service, the customer clicks on a button on the invoice screen that sends the payment information to American Express, which creates the check and mails it to the recipient, while the invoice is closed and posted. The main attraction for Intacct customers is that the nominal charge per check is likely less than their fully loaded cost of producing and mailing one themselves; there is the added benefit of reducing the risk of having check stock on hand in a company. Moreover, creating and mailing checks is one of those chores that soak up far more time than companies realize. Intacct cited an average of two to four hours per week that a midsize company spends on printing and sending checks. Other than saving time and money, the payment process for Intacct customers will be unchanged because it doesn’t require any relationship with American Express. The funds come directly out of the company’s bank account, and all of the company’s existing fraud controls and payment processes remain in place. The service is limited to the United States, but this is where the bulk of Intacct’s customers currently are located and have business relationships. It’s not clear what the economic benefits are for American Express, but this is just the first step in a strategy that would enable that company to develop higher value (and more lucrative) payment and cash management services for the Intacct customer base. American Express intends to develop working capital management services, add international payments (that might offer better foreign exchange rates than most companies can get with their local bank) and ultimately offer a range of treasury management services, including analytics, forecasting and cash management.

Analytics, reporting and data visualization have long been weak spots in cloud ERP systems designed for midsize companies. Intacct recognized this and has been making improvements in this area. For example, its latest release enables users to drill down into the underlying details of the performance cards on its dashboards. The company plans to make a stream of these sorts of improvements next year in its quarterly releases.

One of Intacct’s objectives is to change the design of reporting from serving accountants pushing numbers to giving decision-makers ready access to the information they need through dashboards that support management by exception and self-service reporting. Self-service reporting is designed to eliminate the time spent by analysts and others in finance organization on repetitive work with limited value so they can focus on more valuable tasks. In many midsize companies, it’s not uncommon for even a finance executive to spend time creating periodic reports, which is certainly not the best use of that individual’s time. As I’ve noted, self-service reporting starts with the basic assumption that individuals in organizations must be able to retrieve information they need from the systems they use and take responsibility for doing so. This supplements but does not replace periodic enterprise reporting, dashboards, scorecards and other such “push” communication methods.

All of Intacct’s advances come in the context of cloud computing. Our benchmark research shows that more than half (55%) of companies are using cloud computing, and one-third (34%) more intend to. Cloud deployment has come to dominate many business application categories such as HR, marketing, sales, and travel and entertainment expense reporting, displacing on-premises deployments On the other hand, ERP is still firmly based on-premises, providing ongoing license revenue for software vendors, although revenue for cloud ERP vendors has been growing faster than on-premises in the past few years. Until now, many companies have been reluctant to embrace the cloud for ERP. That is likely to change over the coming decade as security issues diminish and companies decide to take advantage of the cloud’s benefits. Automated payments and better collaborative capabilities can make a cloud-based system such as Intacct’s more attractive. I recommend that companies replace entry-level accounting packages that no longer support their ability to grow. Many of these companies will find that a cloud-based offering is the most practical option. Likewise midsize companies that need to replace their existing on-premises financial management system also should weigh the pros and cons of a cloud-based package. Both these types of companies should evaluate Intacct as an option.

All of Intacct’s advances come in the context of cloud computing. Our benchmark research shows that more than half (55%) of companies are using cloud computing, and one-third (34%) more intend to. Cloud deployment has come to dominate many business application categories such as HR, marketing, sales, and travel and entertainment expense reporting, displacing on-premises deployments On the other hand, ERP is still firmly based on-premises, providing ongoing license revenue for software vendors, although revenue for cloud ERP vendors has been growing faster than on-premises in the past few years. Until now, many companies have been reluctant to embrace the cloud for ERP. That is likely to change over the coming decade as security issues diminish and companies decide to take advantage of the cloud’s benefits. Automated payments and better collaborative capabilities can make a cloud-based system such as Intacct’s more attractive. I recommend that companies replace entry-level accounting packages that no longer support their ability to grow. Many of these companies will find that a cloud-based offering is the most practical option. Likewise midsize companies that need to replace their existing on-premises financial management system also should weigh the pros and cons of a cloud-based package. Both these types of companies should evaluate Intacct as an option.