Crypto trading is a risky activity that may lead to substantial losses. The author doesn’t take responsibility for any consequences of the readers’ deals.

What do you think about expert steel-makers? What about professional truck drivers? How do committed teachers feel? All of them succeed because they dedicate everything they have to one occupation or one goal. They try hard to reach the industry’s heights and find a reward: money, fame, stability, etc. And crypto traders do exactly the same. Hence, let’s discover which obstacles lie in wait crypto masters.

Note that this article is focused on issues of pro market players. Newcomers and somewhat experienced investors feature slightly different problems. Still, feel free to explore the info to understand the life of professionals.

Being a Professional Trader

Let’s begin with a simple point. How to understand whether you’re a master or not? Generally, traders who ask this question in any form (publicly on forums, in friend chats or during inner dialogues) aren’t pros. Still, some experts tend to undervalue themselves so catch five distinctive features:

- A stable trading plan but also intuition and ability to adapt to changes.

- Complete resilience that comes together with accepting errors and losses.

- Non-stop work on trading, analysis, record keeping, and analysis once more.

- Risk management, e.g. understanding of acceptable and too dangerous risks.

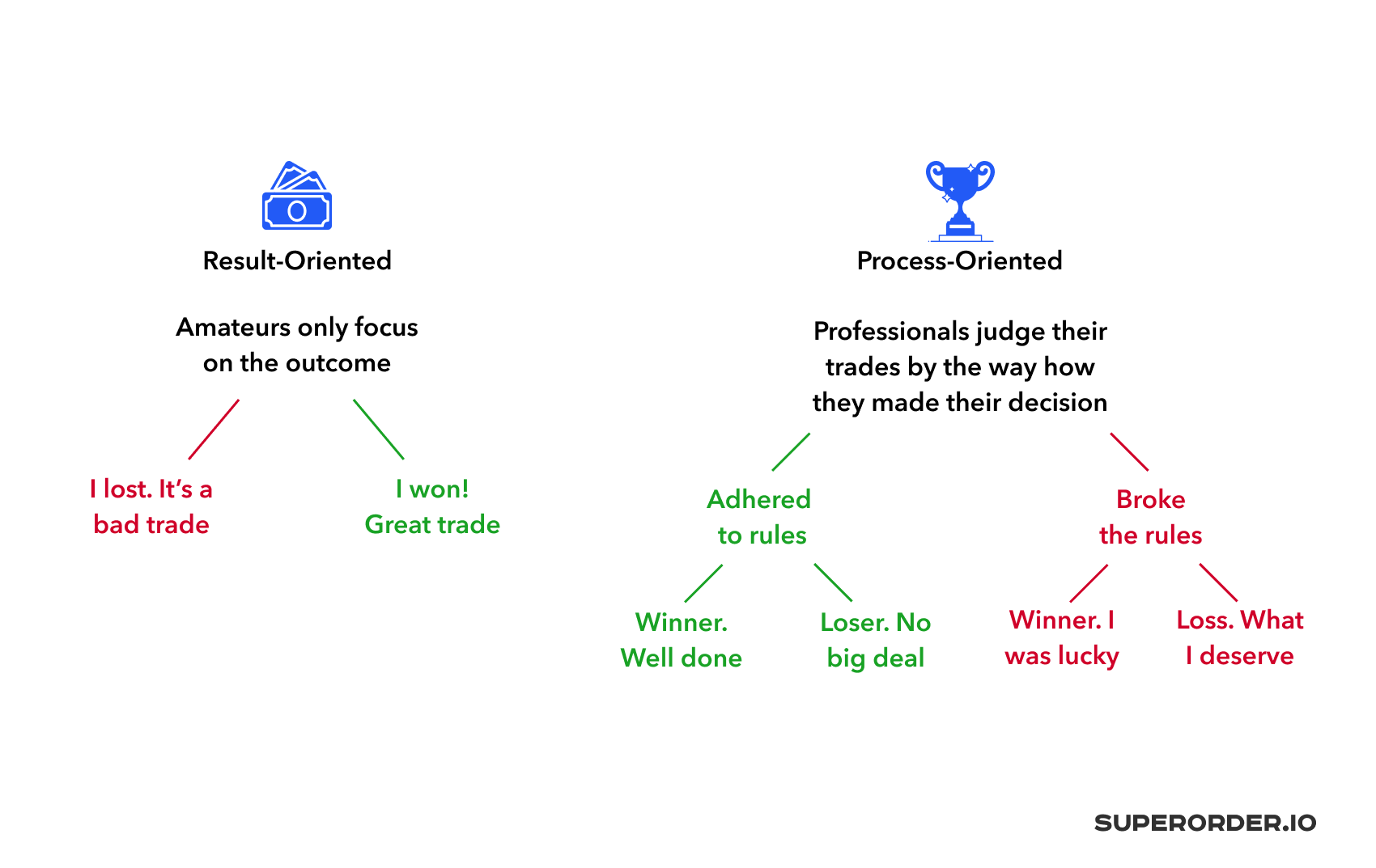

- The growth mindset with main focus on the process instead of the results.

You can find more revelations of real traders on social networks. For instance, magik_moose from Reddit states that pros must follow a few rules, including proper risk management, clear targets, independent analysis, and control over emotions. Of course, the main idea repeated in various sources refers to developing a strategy and sticking to it.

Major Drawbacks of Pro Crypto Trading

Is it all clear with the peculiarities of experts? Nice, let’s move further. You’re totally wrong if you think that being a pro means living in paradise, getting constant passive profits, and relaxing in the jacuzzi. Professional trading is a routine job. Depending on the trader’s personality and official occupation, this job can be similar to 8-hour workdays in the office or look like a never-ending movie with charts starring.

Precisely, there are six defining problems of crypto professionals.

1. Cognitive/Emotional Mismatch

Put very simply, human beings tend to step out of their plans when they feel uncomfortable. When it comes to trading, professionals often feel extremely powerful dissonance between their cognitive goals (earn money stably by making elaborate deals) and emotional state (not to lose money by all means).

The mismatch occurs when the crypto market behaves unpredictably. Yeah, it occurs almost always. For example, a profitable trading strategy with 2x, 3x, 5x profits in the past suddenly fails and leads to equal losses. Even the best experts may face this dissonance with subsequent emotional changes of plans. Here, the disruptive cycle starts.

There’s an amazing two-part (one and two) story about cognitive/emotional mismatch by psychologies and adept of behavioral finance Brett N. Steenbarger. Explore it to understand your nature better.

Solution(s): Mr. Steenbarger reveals that it’s essential to analyze markets in terms of important events, not a general timeline. For this, a trader should learn and watch for volatility, volume, correlation movements, unusually weak or strong sectors, and the ratio between pumping and dumping coins. It should help to catch the industry’s pace.

2. Isolation OR Crowds

This problem is bilateral. On the one hand, trading is all about loneliness. When you play high, you can barely trust so-called colleagues because they also hunt for the best profits. All your deals with gains and losses are only yours. It may be convenient for introverted people but it also may destroy you from within.

Another side of professional trading as the main job is all these people around you. Not traders, just folks. They want to know why BTC isn’t at $100,000 yet, which coins will skyrocket tomorrow, how to start investing, is crypto mining still profitable, who is Satoshi Nakamoto… You got it, huh?

Solution(s): as long as this problem is based on social aspects, you just should understand yourself. Extraverts can take regular breaks from trading to hang out with friends or watch movies with their significant others. Introverts also shouldn’t forget about rest but they want to spend evenings alone. Alone, without charts!

3. Not as Universal Skillset

Another hidden issue relates to specialized and barely transferrable trading skills. Professionals consider it the biggest and the most threatening issue because of unstable economies. In case of major crypto bubble burst, thousands of committed traders will stay out of work. It means that pro traders are doomed to make deals for life. Of course, it’s not an issue for youngsters who can switch quickly. But what about others?..

Solution(s): find time to develop other skills. Without shifting too much, study financial management, try to provide consultations, work with banks, and so on. Nevertheless, you also can master a completely different profession like a lumberjack or a travel agent. Just be sure that it’s interesting and rewarding enough.

4. Significant Level of Stress

It’s a simple one. The more time and energy you dedicate to any activity the more stress it generates in case something isn’t going according to plans. Because crypto traders have to be good all the time, they may face significant burnout. Markets constantly remind of your incompetence, you know. It leads to problems with health, various diseases, and early death. Yes, stress is a pretty undervalued threat of the modern world.

Solution(s): sometimes, it’s not an issue for pros at all. When you consider the trading as a routine job it becomes, well, casual. People don’t go crazy because of Excel crash or broken fan in the office, right? Also, consider stress relief stuff like parties, movies, travels, favorite books accompanied by a cup of hot tea, and so on.

5. Tech Issues of Exchanges

Crypto traders have no choice but to use one or another exchange. These platforms act as auxiliary interfaces for people who buy and sell coins. Generally, there are two types of crypto exchanges:

- Centralized – traditional server-based sites that are vulnerable to hacks and data leaks. In total, more than $1.35 billion were stolen from these platforms, including the insane amount of 750,000 BTC taken from Mt. Gox in 2014.

- Decentralized – blockchain-based exchanges with all the necessary security measures. The bad news is DEXs lack liquidity and often come with tangled interfaces. Thus, people prefer centralized analogs.

In a nutshell, pro traders face both security and liquidity issues. Users of CEXs are afraid of potential hacks while adepts of decentralization rarely can make big deals because these markets work on low volume. Statista also includes high fees, lack of crypto pairs, poor customer support, and inconvenient interface to the list of issues.

Solution(s): to be honest, this problem is familiar with all types of traders. We can suggest prioritizing features. If you need high liquidity, look for reliable centralized exchanges that were never hacked. If you prefer perfect security, focus on the most popular decentralized systems. That’s it.

6. Trading, Trading, and Trading Again

It’s tempting to make huge profits by dedicating your entire life to the trading/analysis process. Experts often face irregular workdays, lack of weekends and holidays, extremely small amount of spare time, and other issues related to the non-stop crypto universe. As a result, investors ignore their close ones. Such an approach may ruin your personal life and harm health significantly.

Solution(s): if it’s difficult to plan your recreation, we’d suggest opting for automated trading. There are several API-based crypto terminals such as Superorder that automate orders’ placing and execution. For instance, with this solution, you can create complex strategies and let the system run them at exchanges. And it doesn’t require coding skills!

The Trader’s Life: To Be or Not to Be

Innovative industry, profitable assets, various wonderful tools to automate trading – it’s all about the crypto market. Modern traders are in more favorable conditions than traditional stock-and-bond investors who rely on telephony and brokers. The catch is that primal problems are the same. As far as only you’re responsible for trading actions and results, only you can decide if it’s your path.

As for experienced professionals, we listed solutions to key issues. Now, catch the final tip: remember that there are things you can control and ones you can’t. Know the edge between them to avoid stress and burnout. Good luck!