Is the market research industry really interested in next gen innovation and quality?

For those of you who haven’t heard yet, the greatest source for B-B market research sample just closed their doors. That’s right, LinkedIn is no longer offering sample to market research suppliers.

For some this news will probably come as a huge relief. For other Next Gen Market Researchers like myself, with great disappointment. Unfortunately, probably for the majority of market researchers though will be indifferent to the news. For if they were not, LinkedIn sample would still be available.

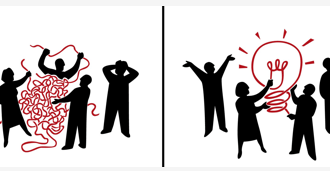

So what happened? Surely an industry which gives quality and innovation so much attention would flock to something as innovative and high in quality as LinkedIn sample?

Anderson Analytics was lucky enough to be one of the first companies to work with LinkedIn sample in 2008, and as far as I know the only outside company to merge behavioral and text data with survey data. One of the areas we investigated when segmenting LinkedIn users was their membership across various market research panels.

Among the n=2000 LinkedIn members who responded to that first survey, 68% had never been on...

Is the market research industry really interested in next gen innovation and quality?

For those of you who haven’t heard yet, the greatest source for B-B market research sample just closed their doors. That’s right, LinkedIn is no longer offering sample to market research suppliers.

For some this news will probably come as a huge relief. For other Next Gen Market Researchers like myself, with great disappointment. Unfortunately, probably for the majority of market researchers though will be indifferent to the news. For if they were not, LinkedIn sample would still be available.

So what happened? Surely an industry which gives quality and innovation so much attention would flock to something as innovative and high in quality as LinkedIn sample?

Anderson Analytics was lucky enough to be one of the first companies to work with LinkedIn sample in 2008, and as far as I know the only outside company to merge behavioral and text data with survey data. One of the areas we investigated when segmenting LinkedIn users was their membership across various market research panels.

Among the n=2000 LinkedIn members who responded to that first survey, 68% had never been on a research panel, 18% had been on a panel but left, and 14% were currently in some panel. More interesting perhaps was that when comparing current panel members to lapsed panel members, lapsed panel members were significantly more likely to have higher salaries, higher positions at their companies.

Should this be a surprise for anyone? What serious business person has 30 minutes of time to waste on a survey for an Amazon certificate?!

I reached out to a few current and former LinkedIn employees as well as some other MR colleagues who had worked with LinkedIn to understand what had happened. [Bob Lederer is also covering the news in this month’s RBR]

The official answer given to me by LinkedIn’s Senior Director of Enterprise Solutions, Dan Shapero is that

Research continues to be a strategic focus at LinkedIn, though we’ve decided to refocus our research efforts to help LinkedIn grow its largest revenue lines faster. We’re deploying research products that help us build larger relationships with our HR and advertising clients, as well as continuing to offer sample to a handful of strategic research clients. We are no longer making our sample generally available.

Dan preferred to talk about the decision as a re-prioritization of assets rather than an economic one.

I can’t blame LinkedIn at all. All businesses are limited in resources and must focus their attention where it will yield the biggest return on investment.

Basically, there is more money in advertising and other areas than in market research. Market research will be provided as part of large advertising sales. But margins on pure market research just aren’t worth the effort.

As much lip service as is given to the desire for innovative techniques and higher quality sample. When push comes to shove, market researchers aren’t willing to give up their 30 minute surveys for more reasonable 5-10 minute better thought out concise instruments, and aren’t willing to pay for greater quality.

This focus on cost cutting, with disregard of almost everything else, may explain why the concept of knowledge process offshoring seems to have grown so fantastically since 2001.

What does this mean for us market researchers who are truly devoted to quality and innovation? Will we have to accept low margins or move towards a different industry?

For now I remain cautiously optimistic about the potential for market research and social networks, and seek to work with other market researchers who are also truly serious about innovation and quality.

Link to original post