To impact business success, Ventana Research recommends viewing predictive analytics as a business investment rather than an IT investment. Our recent benchmark research into next-generation predictive analytics reveals that since our previous research on the topic in 2012, funding has shifted from gene

To impact business success, Ventana Research recommends viewing predictive analytics as a business investment rather than an IT investment. Our recent benchmark research into next-generation predictive analytics reveals that since our previous research on the topic in 2012, funding has shifted from general business budgets (previously 44%) to line of business IT budgets (previously 19%). Now more than  half of organizations fund such projects from business budgets: 29 percent from general business budgets and 27 percent from a line of business IT budget. This shift in buying reflects the mainstreaming of predictive analytics in organizations, which I recently wrote about .

half of organizations fund such projects from business budgets: 29 percent from general business budgets and 27 percent from a line of business IT budget. This shift in buying reflects the mainstreaming of predictive analytics in organizations, which I recently wrote about .

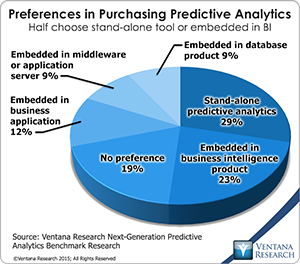

This shift in funding of initiatives coincides with a change in the preferred format for predictive analytics. The research reveals that 15 percent fewer organizations prefer to purchase predictive analytics as stand-alone technology today than did in the previous research (29% now vs. 44% then). Instead we find growing demand for predictive analytics tools that can be integrated with operational environments such as business intelligence or transaction applications. More than two in five (43%) organizations now prefer predictive analytics embedded in other technologies. This integration can help businesses respond faster to market opportunities and competitive threats without having to switch applications.

The features most often sought in predictive analytics products further confirm business interest. Usability (very important to 67%) and capability (59%) are the top buying criteria, followed by reliability (52%) and manageability (49%). This is consistent with the priorities of organizations three years ago with one important exception: Manageability was one of the two least important criteria then (33%) but today is nearly tied with reliability for third place. This change makes sense in light of a broader use of predictive analytics and the need to manage an increasing variety of models and input variables.

The features most often sought in predictive analytics products further confirm business interest. Usability (very important to 67%) and capability (59%) are the top buying criteria, followed by reliability (52%) and manageability (49%). This is consistent with the priorities of organizations three years ago with one important exception: Manageability was one of the two least important criteria then (33%) but today is nearly tied with reliability for third place. This change makes sense in light of a broader use of predictive analytics and the need to manage an increasing variety of models and input variables.

Further, as a business investment predictive analytics is most often used in front-office functions, but the research shows that IT and operations are closely associated with these functions. The top four areas of predictive analytics use are marketing (48%), operations (44%), IT (40%) and sales (38%). In the previous research operations ranked much lower on the list.

To select the most useful product, organizations must understand where IT and business buyers agree and disagree on what matters. The research shows that they agree closely on how to deploy the tools: Both expressed a greater preference to deploy on-premises (business 53%, IT 55%) but also agree in the number of those who prefer it on demand through cloud computing (business 22%, IT 23%). More than 90 percent on both sides said the organization plans to deploy more predictive analytics, and they also were in close agreement (business 32%, IT 33%) that doing so would have a transformational impact, enabling the organization to do things it couldn’t do before.

However, some distinctions are important to consider, especially when looking at the business case for predictive analytics. Business users more often focus on the benefit of achieving competitive advantage (60% vs. 50% of IT) and creating new revenue opportunities (55% vs. 41%), which are the two benefits most often cited overall. On the other hand, IT professionals more often focus on the benefits of increased upselling and cross-selling (53% vs. 32%), reduced risk (26% vs. 21%) and better compliance (26% vs. 19%); the last two reflect key responsibilities of the IT group.

Despite strong business involvement, when it comes to products, IT, technical and data experts are indispensable for the evaluation and use of predictive analytics. Data scientists or the head of data management are most often involved in recommending (52%) and evaluating (56%) predictive analytics technologies. Reflecting the need to deploy predictive analytics to business units, analysts and IT staff are the next-most influential roles for evaluating and recommending. This involvement of technically sophisticated individuals combined with the movement away from organizations buying stand-alone tools indicates an increasingly team-oriented approach.

Purchase of predictive analytics often requires approval from high up in the organization, which underscores the degree of enterprise-wide interest in this technology. The CEO or president is most likely to be involved in the final decision in small (87%) and midsize (76%) companies. In contrast, large companies rely most on IT management (40%), and very large companies rely most on the CIO or head of IT (60%). We again note the importance of IT in the predictive analytics decision-making process in larger organizations. In the previous research, in large companies IT management was involved in approval in 9 percent of them and the CIO was involved in only 40 percent.

As predictive analytics becomes more widely used, buyers should take a broad view of the design and deployment requirements of the organization and specific lines of business. They should consider which functional areas will use the tools and consider issues involving people, processes and information as well as technology when evaluating such systems. We urge business and IT buyers to work together during the buying process with the common goal of using predictive analytics to deliver value to the enterprise.