I recently attended Vision 2013, IBM’s annual conference for users of its financial governance, risk management and sales performance management software. These three groups have little in common operationally, but they share software infrastructure needs and basic supporting software components such as reporting and analytics. Moreover, while some other major vendors’ user group meetings concentrate on IT departments, Vision focuses on business users and their needs, which is a welcome difference. For me, there were three noteworthy features related to the finance portion of the program.

I recently attended Vision 2013, IBM’s annual conference for users of its financial governance, risk management and sales performance management software. These three groups have little in common operationally, but they share software infrastructure needs and basic supporting software components such as reporting and analytics. Moreover, while some other major vendors’ user group meetings concentrate on IT departments, Vision focuses on business users and their needs, which is a welcome difference. For me, there were three noteworthy features related to the finance portion of the program. First, IBM continues to advance its financial performance management (FPM) suite and emphasizes its Cognos TM1 platform to support a range of finance department tasks. Second, the user-led sessions illustrated improvements that finance departments can make to their core processes today, ones that improve the quality of these processes and go a long way toward enabling Finance to play a more strategic role in the company it serves. Third, the Cognos Disclosure Management product has better performance and useful new features to support the management of a full range of internal and external disclosure documents, including the extended close, which I have discussed.

It’s customary for companies to produce a slew of press releases to coincide with big conferences or user group events. Thus it’s interesting that IBM made no such announcements in this case: Product releases either happened months ago or are scheduled for later this year. This was probably incidental, but the lack of hoopla also reflects a good read of the audience attending this event (which tends to be skeptical, especially of anything that smacks of sales and marketing bombast) as well as recognition that the market is still catching up with FPM suite capabilities that have been available for years. From a user or potential user’s perspective, what’s old is still new.

Our Financial Performance Management Value Index evaluates suites of financial performance software rather than individual components for which IBM was rated Hot in 2012. There is a long-running debate on whether companies should buy suites of software or individual components. I advise companies to take the suite approach unless components fall short of business requirements because a suite can be – this isn’t guaranteed – less expensive to buy and maintain. It also may facilitate training and operations if there is a common interface and a single sign-on capability. A core element of IBM’s FPM product strategy is to emphasize its unified architecture to support a range of core finance department activities. This point was rarely stated explicitly at the conference probably because people working in non-IT roles are more focused on the benefits that come with this approach. IBM’s architecture facilitates the integration of specific finance functions such as planning, budgeting, forecasting, statutory consolidation and creation of disclosure documents as well as providing complementary capabilities such as performance management (including scorecards and dashboards and reporting) and analytics.

In particular, Cognos TM1 is enterprise planning software that helps manage the full planning cycle: business modeling, strategic and long-range planning, target setting, operational planning, budgeting and reviewing, along with the reporting and analytic functionality needed at each step. TM1 serves both midsize and larger companies. For the former, Cognos Express offers an integrated platform with standardized reporting, ad-hoc analysis and planning with an in-memory analytic server that utilizes a Microsoft Excel interface. Express is designed for smaller organizations with very limited IT capabilities. The in-memory architecture facilitates all planning and forward-looking activities. It enables organizations to quickly run even complex detailed models against large data sets. Having the ability to rapidly iterate scenarios with specific assumptions (as opposed to simplistic base, upside and downside cases) enables senior executives as well as line managers to have more forward visibility and anticipate the consequences of specific business scenarios and the impact of potential responses to different scenarios.

Software that utilizes in-memory processing has the capability to change the design of planning to create models to work as easily with the things used in running a business (units of materials or parts, hours of labor or purchase orders processed, to name just three) as well as the financial and accounting aspects. In-memory systems could become the tipping point in how companies plan and budget in the future. When weekly or monthly operational reviews are able to focus more on assessing future operational alternatives and their financial consequences and less on historical accounting data, it will enable a fundamental shift in corporate management. The planning-budgeting-review-reforecast cycle will become more useful for those running a company in adapting to the changing currents of markets and economic conditions. The emphasis will shift to achieving business success from focusing on budget conformity.

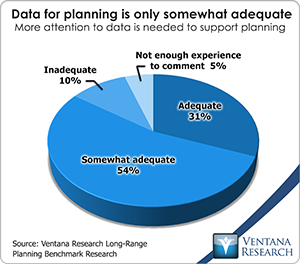

Another potential advantage of a suite is that it can simplify data management. (But keep in mind here that other data management strategies can achieve the same aim, and in practice organizations can do a poor job of managing data even with the best system architecture.) In the future, it probably won’t matter where a finance  department collects its data, keeps its applications and stores its reports. For the moment, though, there is value in having a single system dedicated to the needs of the department to ensure data accessibility, consistency, timeliness and accuracy. A unified architecture also facilitates the creation and maintenance of a unified data set to keep everyone working off the same numbers that are more accurate, consistent and contemporaneous. In addition, IBM’s recent acquisition of Star Analytics has made Essbase data sources, such as those used by Oracle Hyperion, readily available to FPM users. Our research finds that data issues are a common impediment to the execution of business functions. For example, as the chart illustrates, just one-third (31%) of participants in our long-range planning research said the data they work with is adequate.

department collects its data, keeps its applications and stores its reports. For the moment, though, there is value in having a single system dedicated to the needs of the department to ensure data accessibility, consistency, timeliness and accuracy. A unified architecture also facilitates the creation and maintenance of a unified data set to keep everyone working off the same numbers that are more accurate, consistent and contemporaneous. In addition, IBM’s recent acquisition of Star Analytics has made Essbase data sources, such as those used by Oracle Hyperion, readily available to FPM users. Our research finds that data issues are a common impediment to the execution of business functions. For example, as the chart illustrates, just one-third (31%) of participants in our long-range planning research said the data they work with is adequate.

User-led sessions at Vision 2013 focused on the nuts and bolts of achieving success in deploying FPM software. These demonstrations are a main reason why people attend user conferences. Here the sessions underscored the disparity in maturity we find in how companies approach financial performance management. They often pointed out the data and IT infrastructure challenges most face when attempting a transformative change in a finance organization. The takeaway of most of these success stories was the need to change management of some core process. For this reason, to summarize the lessons learned from the presentations, the first key to success typically is executive buy-in coupled with repeated communication of the objectives. Promoting accountability is often an important motivation for FPM initiatives, and that requires accurate and consistent data to ensure buy-in. Although plenty of companies are proving the value of software in managing more effectively, we had enough conversations with those in the trenches to confirm that in areas like planning and budgeting, analytics and scorecarding, maturity levels are still low.

Today’s FPM suites are designed to require as little IT involvement as possible, a feature that all vendors emphasize. One session at the conference, however, served as a reminder that for most larger companies these systems are never “hands free.” Even well-designed software can be configured improperly or require modification as use evolves. For example, unless TM1 is properly configured, senior executives reviewing corporate plans as a deadline approaches could experience frustration because the numerous last-minute adjustments to individual plans can bog down a system’s performance. The circumstances and fixes for these sorts of issues differ between software packages and companies. However, a universal best practice companies must follow is having an ongoing dialog between Finance and IT to address issues as they arise, as well as an emphasis in IT organizations on uncovering these sorts of problems and addressing them quickly.

Turning to a specific product, I see Cognos Disclosure Management (CDM) as a welcome upgrade to Cognos FSR. Both products are designed to automate and streamline the process of composing and editing disclosure documents such as the Form 10-K annual report filed with the U.S. Securities and Exchange Commission (SEC) as well as tagging the documents using eXtensible Business Reporting Language (XBRL). I have been enthusiastic about this product category from the start because it facilitates the production of external disclosures, eliminates the need for people to handle repetitive mechanical tasks and promotes accuracy. It allows organizations to focus more on what goes into the disclosure by cutting the effort required to assemble the multiple components. (In general, however, our anecdotal sampling indicates that XBRL tagging is universally viewed as a compliance requirement without benefit to the company.) CDM makes it easier for public companies to handle the tagging process internally rather than having a third party provide this service. My conversations with users confirm that this approach gives them more time to complete their disclosure documents, provides greater flexibility in managing the process (especially in incorporating last-minute changes) and gives the CFO much greater control over decisions about which XBRL tags to use. The revamped CDM is able to handle more users, which is increasingly important as companies use it for more extensive reporting and disclosure activities such as internal reports (for example, board books) and external compliance filings that require the integration of text and numbers.

Well-designed and smoothly run user group meetings are a useful and efficient way for people who have made considerable investments in software to see what others have accomplished and to network with their peers to understand how best to implement change. The software is a consistent topic, of course, but for attendees the people, process and project management elements are equally important. Our benchmark research shows that a majority of finance departments have scope (often considerable) in which to improve the quality of, and the efficiency with which they execute, core processes and support the strategic objectives of their company. Software by itself is only one element, but it can be either enabler or impediment in efforts to improve finance department performance.