Today’s big news is of course that Oracle and Sun Microsystems “have entered into a definitive agreement under which Oracle will acquire Sun common stock for $9.50 per share in cash.”

As Sun’s press release goes on to say, “the transaction is valued at approximately $7.4 billion”. At the time of writing, Sun’s stock was up nearly 36% and Oracle’s was down just over 1%. The price Oracle is paying represents a 42% premium over Sun’s closing stock price on Friday – that’s a big premium.

What is interesting is that the previous mooted IBM / Sun deal appears to have foundered at least partly on issues of price (though potential antitrust issues were also a concern). IBM was rumoured to have offered a price identical to what Oracle will now be paying. So what, taking Larry Ellison’s deep pockets to one side, was the difference?

Well while there seemed to be some synergies for IBM in the earlier deal (a big say in the future of Java obviously being one that would have attracted both suitors), the acquisition of Sun is unarguably a much more transformational event for Oracle. Despite Sun’s recent problems in shifting big iron (funny how UNIX platforms are now viewed that way isn’t it?), Orac…

Today’s big news is of course that Oracle and Sun Microsystems “have entered into a definitive agreement under which Oracle will acquire Sun common stock for $9.50 per share in cash.”

As Sun’s press release goes on to say, “the transaction is valued at approximately $7.4 billion”. At the time of writing, Sun’s stock was up nearly 36% and Oracle’s was down just over 1%. The price Oracle is paying represents a 42% premium over Sun’s closing stock price on Friday – that’s a big premium.

What is interesting is that the previous mooted IBM / Sun deal appears to have foundered at least partly on issues of price (though potential antitrust issues were also a concern). IBM was rumoured to have offered a price identical to what Oracle will now be paying. So what, taking Larry Ellison’s deep pockets to one side, was the difference?

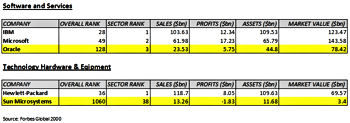

Well while there seemed to be some synergies for IBM in the earlier deal (a big say in the future of Java obviously being one that would have attracted both suitors), the acquisition of Sun is unarguably a much more transformational event for Oracle. Despite Sun’s recent problems in shifting big iron (funny how UNIX platforms are now viewed that way isn’t it?), Oracle post-acquisition will have a product set ,matched by few companies. In fact it will probably be matched by only one: IBM. So, while buying Sun might have made business sense for IBM, it would not have changed the nature of the organisation overnight. Oracle’s announcement today would appear to have done just that, positioning them as the other big beast in the “buy everything from us” jungle. Whether this deal proves successful for all concerned (and not just Sun’s shareholders) is a question whose answer will probably not be clear for a long time.

Stepping back from all this IT fervour for a moment, it is perhaps instructive to compare the merger madness that seems to have taken over the sector with trends outside the technology industry. Here the picture is very different. Over the last 10 years the majority of sprawling conglomerates have been split up; previously cherished businesses have been spun off, or sold to competitors. This has all been in homage to the business school orthodoxy of focus and core competencies. Many an internationally renowned name now sells just a fifth of its previous product set, with other assets now owned by those who can presumably generate greater profit from them and who feel that they are more compatible with their own core strategy. Deals where two similar companies have swapped assets and businesses to create two more distinctive entities have been common. While it is always notoriously difficult to assess the impact of such trends, general opinion seems to be that this phenomenon has generated greater value (or at least destroyed less value) than the previous focus on mergers and acquisitions.

So where does this leave IT with its rash of mega mergers over the last couple of years? Well it could of course be argued that IT itself is a single sector (and thus an area of focus and core competency) and that mergers within the technology sector are not the same as say a consumer electronics firm taking over a Hollywood studio (Sony / Colombia TriStar) or old media taking over new (TimeWarner / AOL). But many elements of Sun and Oracle’s businesses are quite different from each other. Ellison must believe that he can run a more diverse stable and still breed winners. The track record of Oracle successfully managing acquisitions is mostly impressive, so he may have a point. Perhaps bucking the trend towards being highly focussed is a masterstroke. The merger may prove to be a Waterloo for the world’s third biggest software and services firm; but whether they are playing the role of Wellingtion or Napoleon remains to be seen.

Continue reading about this area in: Combinatorics.

Much of the following was originally conatained in a comment, but I then thought that it was more appropriate to add this to the main article.

Some thoughts on this area from bloggers that I follow:

I will add more as I come across them.

Also here is an interesting graphic from MySQL.com, which (if you believe it) shows the impact of the Sun acquistion on Oracle’s market share:

UPDATE: The above chart reflects: “According to the recent JoinVision study ‘Open Source in the Fast Lane’, IT specialists indicated they deploy MySQL 30% more frequently than Oracle, SQL Server or DB2.” Not quite the same thing as market share.

| Bookmark this article with: | |||||

| | | | | | | | | ||