Revenue recognition standards for companies that use contracts are in the process of changing, as I covered in an earlier perspective. As part of managing their transition to these standards, CFOs and controllers should initiate a full-scale review of their order-to-cash cycle. This should include examination of their company’s sales contracts and their contracting process.

Revenue recognition standards for companies that use contracts are in the process of changing, as I covered in an earlier perspective. As part of managing their transition to these standards, CFOs and controllers should initiate a full-scale review of their order-to-cash cycle. This should include examination of their company’s sales contracts and their contracting process. They also should examine how well their contracting processes are integrated with invoicing and billing and any other elements of their order-to-cash cycle, especially as these relate to revenue recognition. They must recognize that how their company structures, writes and modifies these contracts and handles the full order-to-cash cycle will have a direct impact on workloads in the finance and accounting department as well as on external audit costs. Companies that will be affected by the new standards also should investigate whether they can benefit from using software to automate contract management or in some cases an application that supports their configure, price and quote (CPQ) function by facilitating standardization and automation of their contracting processes.

The soon-to-be-implemented revenue recognition standards (called ASC 606 or “Topic 606” in the U.S. and IFRS 15 in most other developed countries) will fundamentally change how companies that use contracts in business account for revenue from them. They will not affect those that rarely if ever use formal or implied contracts in the normal course of business. And almost all corporations that use standard contracts that cover a straightforward transaction (such as a one-time sale of some good or service) where the terms are satisfied within a relatively short period of time are likely to find little change to their accounting treatments and processes. However, corporations that don’t fall into these categories will benefit from a thorough re-examination of the structure and wording of their sales contracts and the processes they use for creating, negotiating and reviewing sales contracts.

To minimize the impact of the new revenue recognition standards on finance department workloads, companies ought to standardize sales contracts and automate as much of the order-to-cash cycle as possible. Although strictly speaking the new revenue recognition process requires companies to manage contracts one-by-one, companies can treat sets of similar contracts or similar performance obligations that are part of a contract in the same way if the overall impact on its financial statements will not be materially different from applying the same approach to the individual contracts or individual performance obligations. In other words, the specific wording of the sales contract is irrelevant if the substance of the contract or individual performance obligations that are part of that contract are substantially the same. Thus the objective of reviewing a company’s sales contracts is to find ways to achieve the highest possible degree of standardization (that is, making contracts, parts of contracts and performance obligations under those contracts identical) or commonality (achieving sufficient similarity to apply the identical accounting treatment). At the end of the review, controllers should be able to implement a process that can map all contract elements to a set of accounting treatments that are at least plausible under the new principles. (Compared to current U.S. accounting standards, the new approach to revenue recognition is more principles-based and far less prescriptive.) Such standardization is extremely helpful in a principles-based accounting approach because it will ensure consistency in how the company treats specific types of contracts and their specific elements. Doing so will facilitate internal reviews and external audits. It will also lay the groundwork for automating the classification of contracts and contract elements, which can reduce finance department workloads as well.

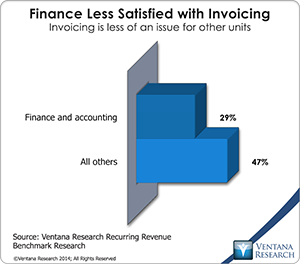

Up to now, a major concern in drafting sales contracts has been covering all the legal bases. Typically, how to organize a contract has been at best an afterthought. This will need to change. CFOs and controllers should insist that all of their sales contracts (or contract templates) be structured in a fashion to make it easy to account for them. By analogy, in the manufacturing world, engineers often constrain their designs to make a product easier or less expensive to produce (for instance, by using similar components across multiple products or relaxing tolerances) or cheaper to maintain (by making replaceable components easier to access). With the advent of the new revenue recognition standards, legal departments or outside counsel must now pay attention to the structure and wording of contracts to facilitate accounting and auditing processes. In negotiating the wording of a sales contract, company representatives must be trained to be sensitive to changes that can have a material impact on revenue recognition from the standard and also to understand when such changes will not make a difference. In the new revenue recognition regime, “sloppy drafting” now includes needless complexity or lack of standardization in a sales contract, not just ambiguities and omissions. Moreover, as much as possible, the wording of the contract should include language that clarifies the accounting treatment by the seller. For example, explicitly stating whether intellectual property that is part of a performance obligation is either symbolic or functional simplifies accounting and auditing by eliminating a potential ambiguity. Making the distinction explicit is useful because that characteristic determines whether revenue from that intellectual property must be recognized over the term of the contract (if it’s symbolic) or at a point in time (if it’s functional). It’s important for finance executives to work with their legal department or outside counsel to appreciate the importance of having sales contracts that minimize workloads for their department. Our benchmark research on recurring revenue suggests that it’s common for people working in one part of a business to be unaware of issues their colleagues in other parts face. For example, when it comes to invoicing the research finds a major disconnect between the finance department and the rest of the company. Nearly half (47%) of participants working outside of finance and accounting said they are satisfied with their company’s ability to produce invoices for their recurring charges, compared to only 29 percent of those in accounting roles. The gulf between the two reflects the reality that when parts of a business process are performed without regard to their impact on finance department operations, invoicing becomes a highly labor-intensive effort. Indeed, of those not satisfied with their invoicing, four out of five (79%) said it requires too much work, two-thirds (68%) said it involves too many resources, and more than half (54%) said it takes too long.

it’s common for people working in one part of a business to be unaware of issues their colleagues in other parts face. For example, when it comes to invoicing the research finds a major disconnect between the finance department and the rest of the company. Nearly half (47%) of participants working outside of finance and accounting said they are satisfied with their company’s ability to produce invoices for their recurring charges, compared to only 29 percent of those in accounting roles. The gulf between the two reflects the reality that when parts of a business process are performed without regard to their impact on finance department operations, invoicing becomes a highly labor-intensive effort. Indeed, of those not satisfied with their invoicing, four out of five (79%) said it requires too much work, two-thirds (68%) said it involves too many resources, and more than half (54%) said it takes too long.

To be sure, standardization is either difficulipt or impractical for very large or complex transactions. And, in some cases, customers will insist (successfully) on writing the sales contract “on their paper.” (That is, the buyer’s side provides the contract that forms the basis of the negotiated result in order to better control the negotiating process and minimize the risk of the buyer being subjected to unfavorable terms and conditions.) However, unless these instances are common and unavoidable, they amount to exceptions that do not affect the need for consistency and commonality in a company’s sales contracts. Even in the case of exceptions, corporations should define and document a standardized framework and process for determining how to handle the accounting in the five-step revenue recognition framework laid out in the standards as easily and consistently as possible.

Invoicing and billing are a part of the order-to-cash process that benefits from automation. This process is relatively straightforward for companies that exclusively or mainly have contracts for stand-alone transactions where the performance obligations to the customer are met over a relatively short period of time (no more than a month or two). Generally, ERP or corporate financial management systems will be able to automate the process and related accounting.

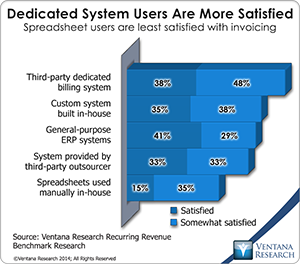

However, companies that engage in subscription or recurring revenue relationships with customers, or those that have contracts covering longer-lived transactions (such as projects), will find it useful to have dedicated software to automate their invoicing and billing and serve as an authoritative source system that drives revenue recognition. Subscription and recurring revenue relationships often involve frequent changes to deliverables, which complicate invoicing and billing as well as the revenue recognition process under the new standards. In our research more than twice as many (86%) companies that use a third-party dedicated billing system said they are satisfied or somewhat satisfied with the software they use for invoicing as those that use spreadsheets (40%).

However, companies that engage in subscription or recurring revenue relationships with customers, or those that have contracts covering longer-lived transactions (such as projects), will find it useful to have dedicated software to automate their invoicing and billing and serve as an authoritative source system that drives revenue recognition. Subscription and recurring revenue relationships often involve frequent changes to deliverables, which complicate invoicing and billing as well as the revenue recognition process under the new standards. In our research more than twice as many (86%) companies that use a third-party dedicated billing system said they are satisfied or somewhat satisfied with the software they use for invoicing as those that use spreadsheets (40%).

Finance executives in companies that will be subject to the new revenue recognition standards should not overlook the impact that the structure of their sales contracts and contracting process can have on their accounting department. I recommend that they scrutinize their contracts and contracting processes to determine how their design can be used to minimize finance department workloads under the new standards. They should examine how well their contracting processes are integrated with invoicing and billing and any other elements of their order-to-cash cycle, especially as these relate to revenue recognition.