With over 30 years in retail site location strategy, I used Census data every day to analyze business critical issues. Where do our customers live? How has that changed in the past decade, and what’s likely to happen in the next 10 years? What is the projected return on this investment? How skilled is the labor force? Can we predict sales behavior? How do customer demographics align with shopping preferences? How does community economic vitality impact company growth?

With over 30 years in retail site location strategy, I used Census data every day to analyze business critical issues. Where do our customers live? How has that changed in the past decade, and what’s likely to happen in the next 10 years? What is the projected return on this investment? How skilled is the labor force? Can we predict sales behavior? How do customer demographics align with shopping preferences? How does community economic vitality impact company growth? Shopping centers, hospitals, housing developments, and infrastructure are built for the long-term and require careful location analysis and insights.

Our Economy Runs on Fact-Based Decisions

Businesses match goods and services to consumer demand. Being in the right place at the right time with the right product is critical to business success. It’s not about luck. While companies use internal data as their analytic secret sauce, performance must be evaluated in the context of the surrounding marketplace. Trends in electronic shopping, ethnic and cultural diversity, urbanization, and the aging of the population will impact business success – and are best illuminated through market and consumer data. Your sales may be growing rapidly, but do you understand similar metrics for the underlying market? Strong sales growth doesn’t necessarily equate to market share gain.

The fact that census data are available from federal government sources for use in business and economic development is not well understood by senior business leaders, members of Congress, or ordinary citizens. Businesses often purchase census data through private data companies, which package census data with value-added enhancements. But make no mistake – the vendor’s products would not be possible without the underlying source data provided by the Census Bureau and other agencies noted here. No private company has the resources or interest in producing accurate, comprehensive, consistent, and timely data for all places in the U.S. across many decades. These data are required by law to provide government leaders and policy makers with accurate information to appropriately fund critical programs and to evaluate their effectiveness and efficiency. But business wisely uses these data to drive sound decisions and economic growth, a competitive advantage for our country.

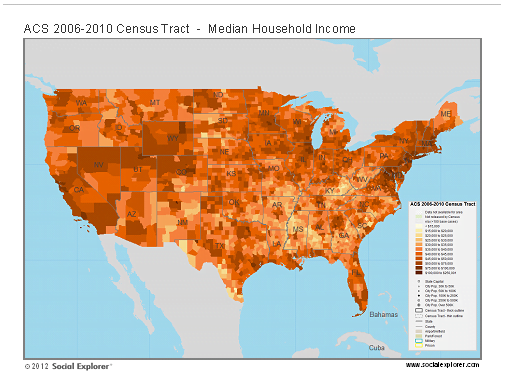

This map displays county data for median household income from the 5-year estimates from the 2006-2010 American Community Survey (ACS). Median income, one of hundreds of available variables, is highly correlated with consumer behavior. Census tract (small area) data are displayed when the user zooms into the map. If the ACS is eliminated or made voluntary, small area income data will disappear.

Map provided by SocialExplorer.com

In 2009, I participated in a Congressional Briefing, “The Ailing Economy: How do Census Data Help?” to share the impact and significance of government data for business decision making with congressional leaders. Collectively, business investment and operations drive trillions of dollars in economic activity through invested capital, moving goods, hiring employees, and providing goods and services in neighborhoods across the country. This in turn drives job and housing growth and community development resulting in economic stability. Stability and growth are always important, but they are top-of-mind in today’s economic environment. Business has an important voice when it comes to educating congress about the critical role that census and economic data play in the everyday decisions made by business.

|

Why is This Issue Important?

This is very important now because the public data that business uses for analytics and investment decisions are at risk of significant cuts or elimination altogether, including the American Community Survey and the 2012 Economic Census. Your voice, the voice of business, can save the data by helping inform Congress of the importance of this data as economic growth drivers. With the help of organizations like the Association of Public Data Users (APDU) and trade organizations like the U.S. Chamber of Commerce and the International Council of Shopping Centers, we are making inroads with members of Congress, telling the story of how the data are unique, reliable, consistent, and timely, and are viewed as the gold standard for business decisions.

How do you use Census Data? Could you do more? APDU would like to engage the business community in education and advocacy for public data. How can you help?

How Business Uses Government Data

While data are collected by government agencies to enable smart and efficient policies and practices, the same information can (and should) be used by the private sector to spur and enhance their own economic success. Public data from the Census Bureau, Bureau of Economic Analysis, and Bureau of Labor Statistics provide business analysts and leaders with critical market and consumer benchmarks. Business uses government data to identify and measure trends, for geographic spatial analytics and location intelligence, as correlates and predictors of consumer behavior, and as metrics for financial and operational decisions. These topics are relevant to the Smart Data Collective community.

Government data help business measure consumer demand and attributes as well as the level and type of competitive supply in geographic markets. Here are some examples:

Market Demand:

- The Census Bureau [Decennial Census and annual American Community Survey] provides rich data about the demographics of consumers in neighborhoods across the country. Examples include population size, income, families and household mix, housing stock (homes or apartments, owned or rental), population turnover, education and occupation (reflecting skills, lifestyle and preferences), ancestry and ethnicity, age profile (seniors, toddlers, young singles), urban or suburban geography, and more. These attributes correlate with consumer behavior and preferences and are used in GIS spatial and analytic systems, to identify a company’s best customers or prospects.

Texas map of median household income from the American Community Survey, 2006-2010 5-Year Estimates, American FactFinder, Census.gov. The ACS is at risk of elimination or the survey may become optional. The data would likely disappear, with no alternate income data available.

- The Department of Labor Statistics provides information about consumer expenditures – what are consumers buying? Does that vary by income or age of the residents or geographic region? Does your product or service match the growth rate in the general market? How is each sector trending? Do consumers spend less on your product or service category due to higher spending in other sectors such as health care, services, or travel?

Market Supply – what is the size and strength of the competition?

- The Census Bureau provides annual data on sector sales and number of business establishments by size with more detailed data provided every five years with the Economic Census. What business sectors are growing rapidly? Is e-commerce growing at the expense of brick & mortar stores? What is your market share? What is the relative strength of each economic sector? Is your business positioned well for the coming changes in the market?

The 2007 Economic Census provided Pennsylvania Supermarket and Other Grocery Store sales for 2007. If the 2012 Economic Census is cancelled due to lack of funds, this information will not be updated until 2017, if at all. The great recession has made 2007 economic data obsolete.

- The Bureau of Economic Analysis provides annual Total Personal Income data for counties, a good measure of spending potential, economic status, and economic change.

How Do You Use Public Data?

These are some examples of business use of government data. How do you use the data? We invite you to contribute ideas and examples. What would you do if the American Community Survey and 2012 Economic Census were eliminated? We welcome your perspective and support.

Joan Naymark is member of the Board of Directors for APDU. She recently retired from Target Corporation, and also worked for the Upper Midwest Council and the Minnesota State Demographic Center. She is Chair of the North American Research Task Force, International Council of Shopping Center and prior Chair of the Business Demography group for the Population Association of America.