Many insurers have been investing heavily in claims systems to reduce costs and improve efficiency, implementing claims processes and web-based claims systems. These validate claims before submitting them and use workflow to reduce costs and improve efficiency. The growth in data volume in claims has led to increased use of analytics and using claims data for early warning fraud detection and monitoring vendors and suppliers.

Many insurers have been investing heavily in claims systems to reduce costs and improve efficiency, implementing claims processes and web-based claims systems. These validate claims before submitting them and use workflow to reduce costs and improve efficiency. The growth in data volume in claims has led to increased use of analytics and using claims data for early warning fraud detection and monitoring vendors and suppliers.

Current approaches have limitations, however. They create manual decision bottlenecks and underutilize business expertise and analytical insights. As claims management becomes widespread, handling decision points becomes critical. For instance, the moment a webform validates a claim’s data and assigns a claim number, a decision point is reached. Often it is clear whether the claim should be approved or not, yet in many claims systems the decision point is handled by workflow with the validated claim being routed to someone for adjudication. This consumes time, money and resources.

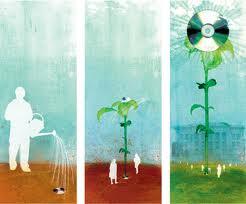

Decision Management claims systems act immediately, improving customer satisfaction and reducing costs. Decision Management claims systems use a rules-based Decision Services to enable ownership by and visibility to the business, allowing for the agility the business requires.

Decision Management claims systems also use advanced analytics. The use of analytics to find fraudulent claims is growing – fraud analysts work on the data to find the key risk factors for fraudulent claims. But this analysis is done after the fact, resulting in a “pay and chase” approach that puts companies on the defensive. Decision Management claims systems apply this fraud insight so the claims that need review are flagged before they are paid, reducing costs and improving the odds of catching fraudsters.

Business Process Management, Business Intelligence and custom development projects have all brought value and cost savings to claims management. Decision point bottlenecks limit these systems because they underutilize business expertise and analytic insight and because they restrict business agility. A new mindset, one focused on the decision points within claims processes, is needed if these problems are to be addressed. Decision Management improves claims processes and systems by externalizing the decisions that drive claims performance. Decision Management ensures that the right claims are approved, that recovery policies are applied correctly and consistently, that the most effective routing is made and that the right actions are taken.

For more about Decision Management Claims Processing, download our new whitepaper from decisionmanagementsolutions.com/resources – no registration required as we have opened up the white paper section.

Final post tomorrow on governance and business optimization.