Big data is changing the financial industry in a truly astounding way. Countless financial professionals are looking towards machine learning and other new tools to improve the quality of the services that they offer to their customers. K. Hussain of Atos Spain published a white paper on the growing relevance of big data in the finance and insurance verticals.

Financial professionals aren’t the only ones utilizing big data to make more informed financial decisions. A number of customers are also turning to big data to make better investments.

How Machine Learning is Revolutionizing the Investment Sector

Deloitte discussed some of the ways that big data can help with investment decision making. They pointed out that Man Group uses AI to help manage $12 billion in assets. Other financial organizations are doing the same.

The same algorithms are helping individual investors as well. They are using big data and AI to power apps to offer investing advice.

Investing Apps Made Possible with AI

Investment apps have gained popularity in recent times, and for a good reason. They allow investors and traders to conveniently analyze and manage stocks anytime and anywhere, regardless of their schedule.

AI and big data have made them possible. Whether you’re a beginner or you’ve been at it for decades, this list of investment apps is worth checking out. They all rely heavily on big data and machine learning.

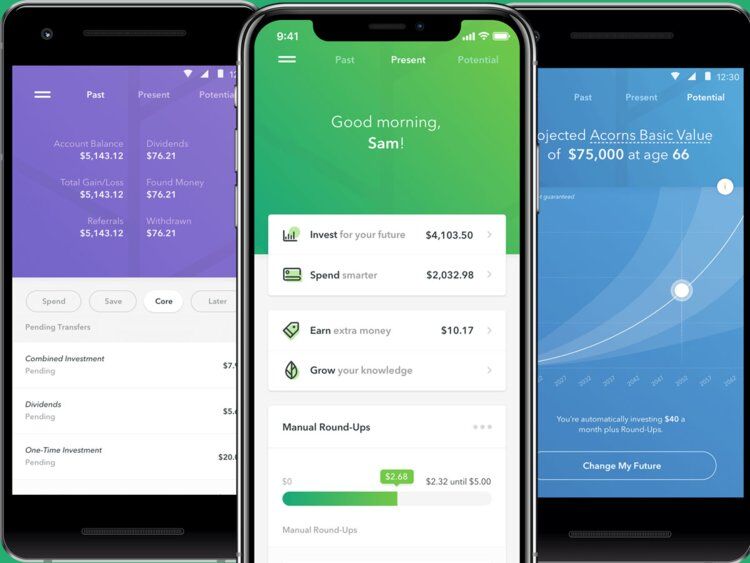

Acorns

Acorn is an app that uses sophisticated machine learning to get to know the user and provide better insights. The advice can be tailored to their financial goals.

Acorns remains popular because of its user-friendliness and ease of application. It works by rounding up your purchases on either your debit or credit card to the next dollar and then saving up the difference in an exchange-traded funds portfolio. This is achieved by simply linking the card to the app regularly, allowing you to build your portfolio and save money without much hassle.

The standard account i.e., Acorns Core goes for one dollar a month while the individual retirement account; Acorns Later goes for two dollars. Also, graduate students who have a .edu email address can use the app free of charge for up to four years.

Robinhood

Are you a trader who is not very fond of fees and commissions? Then Robinhood is the app for you. This app lets you do forex trading, cryptocurrency trade, exchange-traded funds, options, and stocks for free. On top of that, it features a slick and user-friendly interface with easy navigation and effortless movement from one screen to another.

It also features a search function conveniently located at the top of the screen that allows you to access stock pages, as well as produce charts and important market statistics. Also, you get to stay on top of crucial developments via a newsfeed that aggregates economic trends from news and financial platforms, ensuring you stay on top of market changes.

This app wouldn’t have been possible without new AI technology helping them get to know more about market conditions.

Wealthbase

If you’re looking for a fun app to invest and choose stocks, then Wealthbase is your app. With this app, investing is more than a necessary chore. Users can create and play games with family, friends, or coworkers for however long they like – up to 30 days.

What makes this app stand out is the quality of combined social media and stock simulator experience. Users can see which stocks their friends are picking – with daily info on who is winning, and even a little friendly teasing. On top of that, the app loads impressively fast and without glitches.

This is another app that relies heavily on machine learning. Its stock simulator is able to benefit from the data that helps them make better decisions.

Stash

More suited for beginners, Stash offers educational content by teaching users how to manage their savings and investment portfolios through its Stash Coach feature. This feature is a two-part game and learning to help you comprehend the very basics of investing. There are tailored tests that help you do this, as well as a tracking tool that charts your progress as you gain more knowledge. If you want to start forex trading, this is an excellent app to start with.

The first step with Stash is establishing your risk tolerance and investing goals. Though building your investment accounts will be entirely up to you, the app provides some useful suggestions, including diversification ideas. The app goes for 5 dollars at the start, and there are fractional shares available for purchase within the app. You can also open a brokerage account for one dollar as well as an Individual Retirement Account for two dollars every month. If you’re a user under 25, you can access the retirement account free of charge.

Betterment

Betterment was the first-ever robo-advisor to be made publicly available, and it remains one of the best go-to investment apps today. This is thanks in part to its customized portfolio for every user and its affordable price for professional money management. The app helps you establish how risk-averse you are and then manages your portfolio based on that.

The app also has a tax-loss harvesting feature which allows you to sell off securities at a loss to avoid or reduce capital gains tax. It features an asset location strategy which helps clients make investments while attracting the minimum taxes possible. Users can choose between the digital and the premium portfolio. The premium option lets you consult with certified financial planners on mobile any day and time, and it has an account minimum of at least $100,000, accompanied by a 0.40% account managing fee.

Big Data Makes Investment Apps Far More Feasible

Big data is providing a number of benefits for both individual and professional investors. They can use machine learning and AI to better understand market conditions and offer much more detailed insights.

The best app for your investing needs depends on your goals, investing experience, risk capacity, and budget. Before you settle on any option, check out user reviews on Google Play – for Android users, or on iTunes store – for iPhone/iPad users. This will help you know what to expect, as well as the most remarkable features according to other customers.