Big data technology has become very important to the modern financial sector. A growing number of financial institutions are investing in data analytics, AI and similar technologies to improve their business operations.

One of the industries that has been heavily affected by big data is the credit card sector. In 2016, Nate Vickery of Datafloq talked about the changes that big data has created for credit card companies. Vickery points out that big data has helped companies fight fraud, give better offers to customers, identify trends and provide many new opportunities for both customers and merchants.

How do credit card companies offer all of these benefits? They have to collect data from credit card users, which is possible due to the electronic infrastructure that they have already setup.

In order to recognize the changes big data can create for credit card companies, it is necessary to recognize the different features that make these new developments possible. You will also need to understand the general nature of credit cards in the first place before you can understand the impact that big data is having on the industry.

How is Big Data Changing the Credit Card Industry?

Debit and credit cards may be helpful spending tools, but it’s easy to ignore the wealth of information contained inside each piece of plastic. Since they contain so much information, it is easy for merchants and credit card companies to mine this data to make highly nuanced decisions. It’s a good idea to get acquainted with the characteristics of your cards—front and back—so you can utilize them effectively.

Here are some details that you should know about credit cards, so you can recognize the changes big data has created for them.

What Exactly Is a Credit Card?

A credit card is a plastic or metal document issued to a person by a financial organization. We may get one from our bank and use it to make cashless payments. It also enables us to get money now and pay later. It’s called a “credit” card because the bank loans us money to use it to make purchases. It, like a debit card, has a spending restriction for purchasing goods or services or withdrawing cash from an ATM.

What Exactly Is a Debit Card?

A debit card is a form of payment mechanism that enables users to make payments by immediately deducting the payment amount from their account with a single touch. In terms of functionality, a debit card is quite similar to a credit card. It means you may use the debit card to make payments in the same way you would a credit card.

The major distinction is that when you use a debit card, you are using your own money, as opposed to borrowed monies in the case of credit cards. The adoption of debit cards reduces the need to carry cash.

What Is the Difference Between Credit, Debit, And Prepaid Cards?

The distinctions between these cards are obvious. A debit card uses the holder’s current account balance to make payments. Prepaid cards may be used to make payments for retail and online purchases, as well as ATM withdrawals, using pre-loaded cash. A credit card, on the other hand, pays using money borrowed from a financial institution.

There are several sorts of credit cards. Classic cards allow users to borrow money for payments in exchange for repaying the bank within one month (usually from the payment date). The credit limit for gold and platinum credit cards is greater. Payments on revolving credit cards are automatically deferred. Finally, rewards cards accrue perks and offers for cardholders.

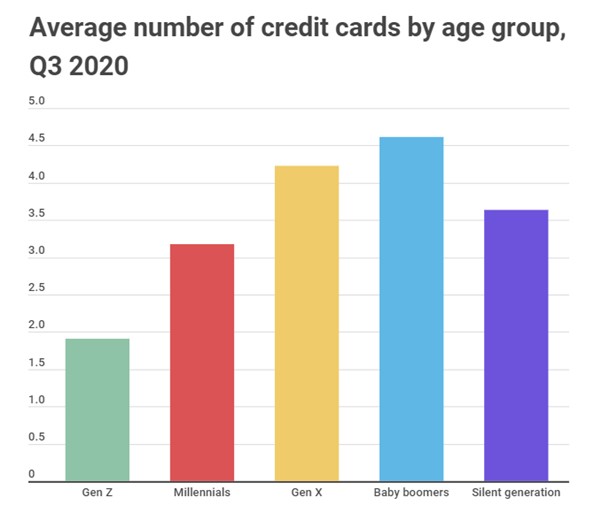

Particularly popular credit cards among Americans, as we can see in the graph below. The majority of cards are carried by older users. In the third quarter of 2020, baby boomers (aged 56 to 74) carried an average of 4.61 cards.

Front of a Debit/Credit Card

- Identification of the bank. This section contains information on your card’s issuer. Cards normally contain your lender’s name, but they may also include a logo for a special program. Some cards, for example, are imprinted with the names of incentive programs or retailers.

- Card Number. This is critical information on your debit or credit card. A card number is a 16-digit number that identifies your card issuer account. When making an online purchase, you must provide your credit card information. You should keep your credit card number secret since it contains sensitive financial information.

- Cardholder’s name. This is the individual who is permitted to use the card. That individual did not necessarily start the account; they may merely have access to it as an “approved user.” Only authorized card users may make transactions with a debit or credit card, and shops are urged to request identification before taking card payments.

- Smart Chips. If you look attentively at the front of your card, you will see a little metal processor on the right front side. Cards with smart chips are more secure than regular magnetic-stripe-only cards.

Smart chips make it far more difficult for criminals to utilize stolen card numbers. If your card contains a smart chip, try putting it into the machine rather than swiping it. This is because the smart chip adds a one-time-only code to each transaction, making stolen data less valuable. - Expiration date. Each card has an expiry date, and when it does, you must renew the card or obtain a new one. The expiry date is critical since the seller may request it when you attempt to make a payment, particularly for online purchases. Your card’s expiry date assures that it is legitimate and operational.

- Logo of a payment network. It is critical to understand the sort of card you have. MasterCard, Visa, and Discover are common examples. When purchasing online, you’ll normally see a drop-down option where you may choose which network your card belongs to.

These logos are also useful if you want to use your card to pay for products or services. Merchants often display stickers or signs indicating which cards they accept. You may always inquire about extra cards.

The Back of a Debit Or Credit Card

Making payments entails more than just entering a credit card number. The back of a debit or credit card contains extra crucial information.

- Magnetic stripe. This black bar, often known as the magstripe, contains all of your account information. It is constructed of millions of small magnetic particles. When you swipe your card through a card reader terminal, the reader reads the magstripe and utilizes it to conduct the transaction.

- Hologram. For enhanced protection, some cards have a hologram or a mirror-like region with a three-dimensional picture. It assists merchants in determining if the card is legitimate or not. Holograms are tough to create, and technology is always evolving. The hologram may display on the face of the card at times.

- Bank Contact Information. The rear of a debit or credit card also provides the bank’s contact information. If you need to contact the bank, look on the back of your debit card for contact information. Furthermore, if you misplace your card, the person who finds it may use this information to return the card to the bank.

- Signature box. This is another fraud-prevention strategy, although it is seldom effective. For the card to be legally legitimate, the cardholder must sign it here, with the purpose that this signature may be matched with a driver’s license or a signature presented at the register when a transaction is made.

You may verify that the individual using the card is the true owner of the card by comparing the signatures or the name on the license.

- Security codes. Cards are printed with an extra code to assist in guaranteeing that anybody using the card number is using a genuine, original card. Merchants often demand more than just the card number and expiry date on the front of your card when accepting payments online or over the phone.

The security code on the back adds another barrier for hackers who may have acquired your card information through merchant systems or using a skimmer. - CVV, CVV2, CVC, CSC, CID, and other similar terms may be used to describe security codes. Most websites simply request a “security code” and give a little box in which to enter it.

- Network Icons. On the reverse of the card, there may be an extra network logo. The logo is usually located in the lower-right corner. These emblems assist you in determining which ATMs are free to use. You may also use other ATMs, however, you may be charged a fee!

Credit Card Companies Track a Lot of Information that Can Be Leveraged with Data Analytics

Credit card companies are relying on big data technology more than ever. They are able to offer a lot of benefits to customers, because they store so much data on them with the various features they provide. Although the personal data credit card companies collect has raised valid privacy concerns, they are also very helpful.

Your card is a useful tool for making payments, but you can do more than simply carry it with you when you go shopping. Big data will make it an even more useful tool, as merchants leverage data to offer better deals and services. Make the most of your card by shopping online, getting cash, paying bills, and sending money to friends and family.