No matter what industry you’re in, identifying creative ways to cut costs is always an important goal. From small startups to major corporations, cost-saving tactics should be an important area to explore. Even when your business cost and costs of production aren’t growing exponentially, chances are everything around you is. Cost of living is rising; customer acquisition is more difficult than ever in such a competitive landscape; and suppliers are looking to increase their profits by upcharging you, too. Fortunately, with the help of data, you can hone in on spending patterns to cut expenses where it matters most. Here’s how data can reduce business expenses and help you grow:

Shipping

Shipping can create a major financial bottleneck for businesses. For many businesses—especially those on the cusp of exploring serious growth—the staggering costs of getting products from Point A to Point B can hold them back.

Shipping intelligence companies like Reveel (launched by former DHL sales executives) use data to help them pinpoint pain areas for businesses struggling to cut margins and increase profit. “We analyze important data points during invoice audits, including deliveries, incorrect addresses and surcharges, incorrect residential surcharges, and more,” says Reveel. “Using insights from the invoice audit analysis we typically find savings between 1-5%, which can then be used in contract negotiations to save up to 20%.”

Ultimately, shipping audits allow you to identify measurable savings and discover a greater level of transparency between your current pricing across carriers. To help you better understand where you can cut shipment costs, opt for a free invoice audit.

Market Testing

As a business, your goal is to connect with your target market in the most cost-effective and efficient way. After all, the ability to determine your target market early on can save you plenty of money. Data makes it possible to target your ideal demographic seamlessly. For example, Chime Bank used artificial intelligence to test 216 versions of its homepage in just three months. Without this technology, the ability to shift and change elements of a homepage based on user data in such a short time period would be impossible, and very time-consuming.

Employee Turnover

Workforce analytics can help you reduce employee turnover—which is likely a bigger issue than you might think. According to data published by the Work Institute, employers will pay an estimated $680 billion in turnover costs by 2020. However, 77% of those turnovers could be prevented using big data. And furthermore, the cost of a bad employee remaining at the company is around 30% of that employee’s annual salary, according to the U.S. Department of Labor.

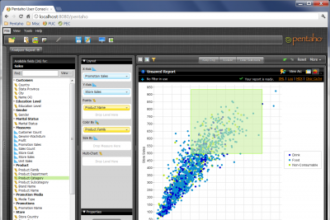

The human resources department is in a unique position to help curb those statistics and ensure the workforce is strategically aligned with the cost factors of a business. Using data, you can identify your resignation rate and commonalities and correlations; use predictive analytics to determine risk of exit; and much more.

Indirect Costs

Indirect costs refer to the expenses of maintaining a company that are not related to the cost of products sold or services offer. For example, paying for a Cision subscription at a PR company is a direct cost associated with services offer and profit made; the rent spent on the workspace your employees use to offer those services is an indirect cost.

According to a study conducted by the Dryden Group, cutting indirect expenses could save your business 25% in overall expenses. And big data is key. Without big data identifying and tracking the cumulation of indirect expenses is difficult. Having access to data that gleans insight on what you’re spending, how you’re spending it, and how those expenses are categorized, will ultimately help you make optimal changes.

Customer Service

Customer service is crucial to your bottom line. After all, poor customer service costs businesses roughly $75 billion per year. Using data technology to both 1) identify weak areas in your customer service strategy and 2) better your customer service, you can prevent your business from losing valuable lifetime customers and sales.

Using data tech from major CRM systems allows you to gain a full picture of every customer. For example, if a customer contacts you, you’re able to pull up a full profile of every touch point that customer has had. This allows you to quickly identify and follow-up on that issue, and creates a much more personalized type of service.